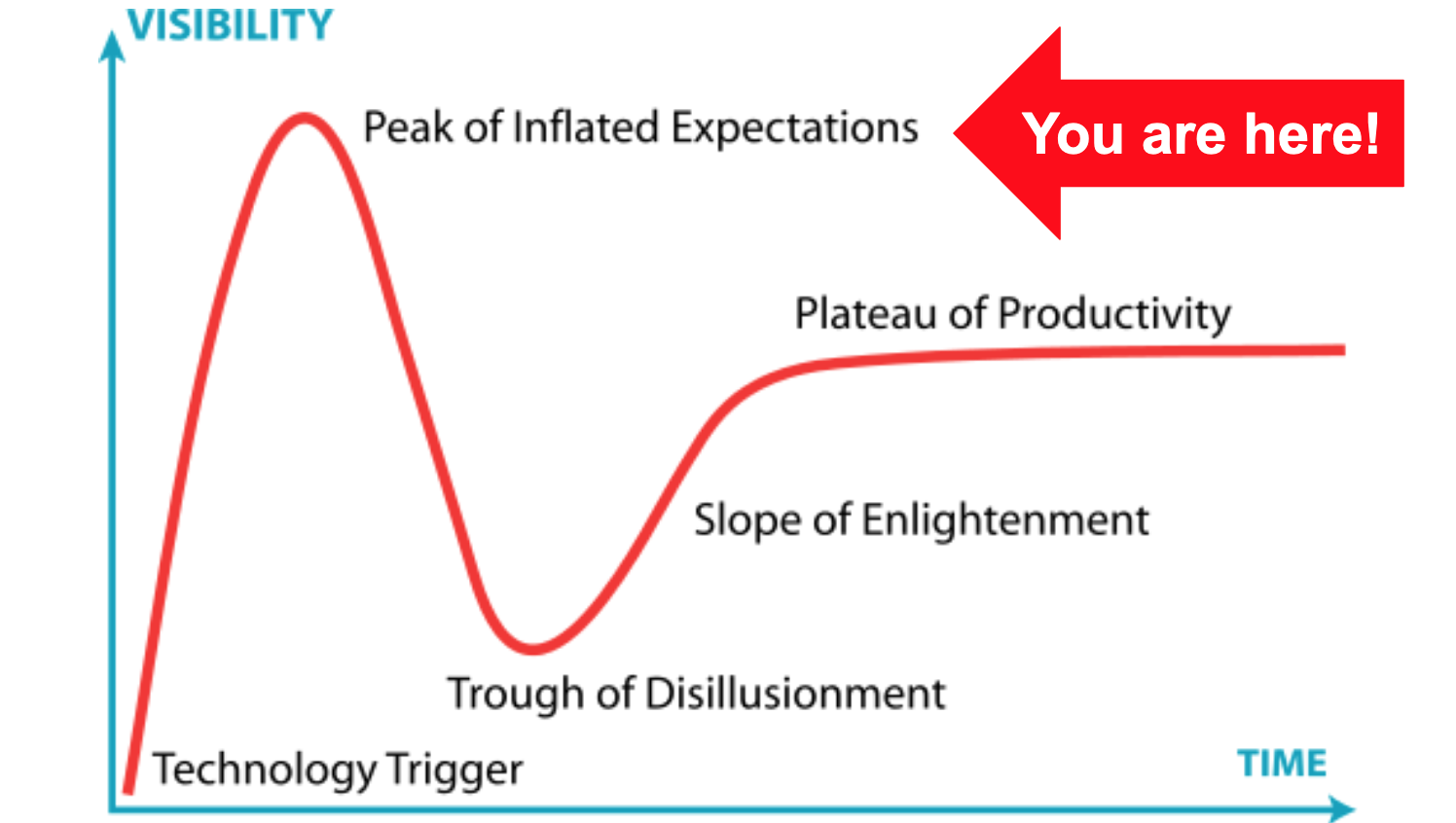

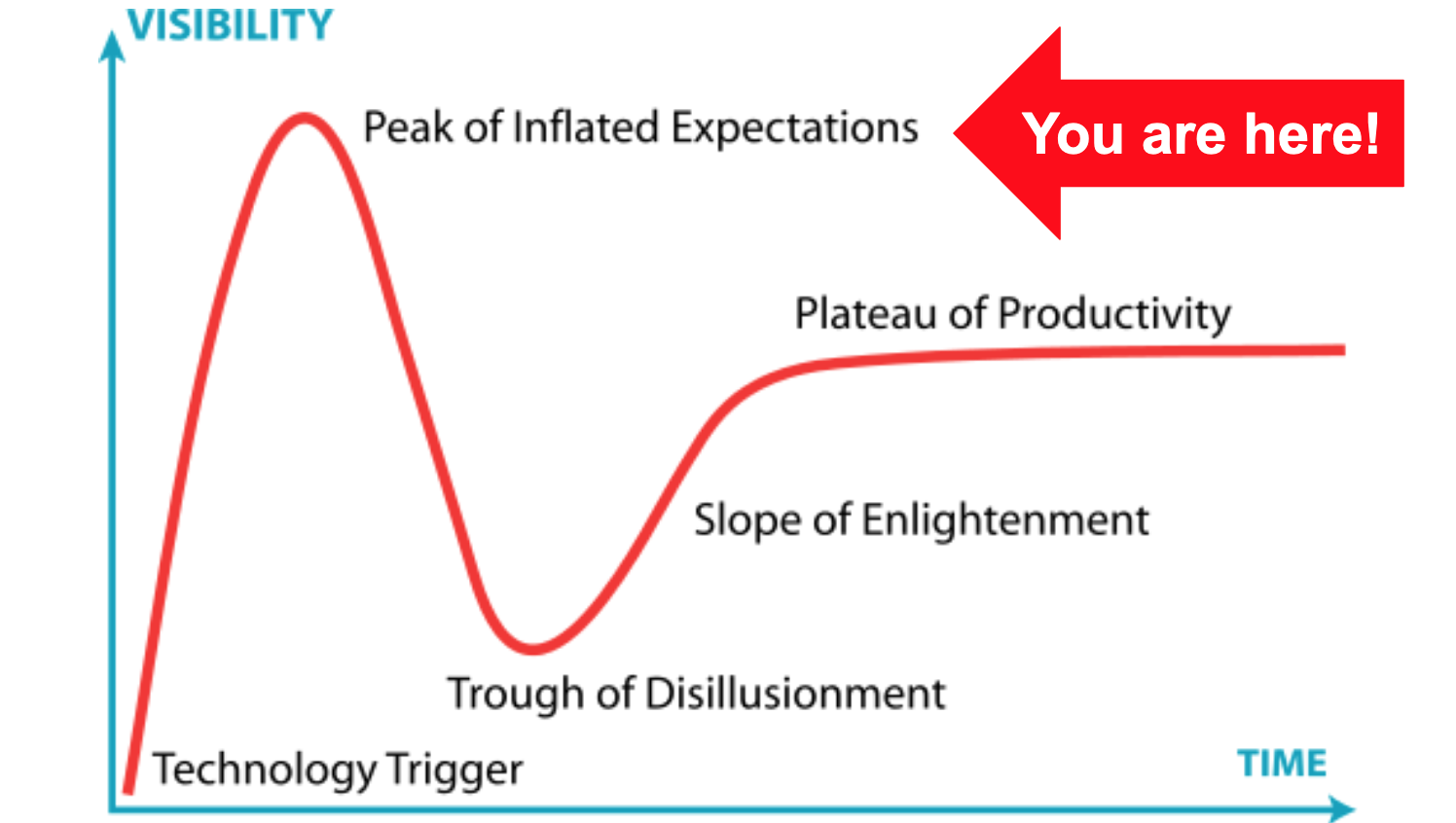

In the past, when the crypto space had been in a bubble, during my times on crypto Twitter (short: "CT"), one popularly debated question had always been that about "inflated expectations." The classic Gartner hype cycle chart informs where the debate stems from.

The line of thinking is this: If indeed, we can rationally prove that there are inflated expectations towards the bubbling technology market, then we can conclude being in a bubble and adjust our financial bets.

On CT in 2018, this led to many long nights of productive debates and eventually, the masses indeed reached a conclusion: blockchain technology wasn't ready for prime time yet. And so what followed was a meteoric period dubbed the "crypto winter", a time and environment where only the strongest saplings ended up thriving in what became known as the "DeFi summer."

And while it was fairly regular seeing anime-avatared accounts making impressively reasonable contributions to the cryptocurrency space, what hadn't been the case yet was animes founding top projects.

The whole space fit some arbitrary city's convention center and people genuinely knew each other beyond just the awkward conference small talk. Getting accustomed to the Ethereum community in 2018 almost felt like becoming part of a big clique or family. These bonds, I believe, are what made it so successful as we came for the smart contracts - but stayed for the fam.

However, during DeFi summer and with the space's insane growth, that social dynamic changed. Not intentionally and for sure quite gradually, but it did. The relevancy of anime-anons grew and with that also their project's significance. Practically overnight, (hostile?) forks like SushiSwap - founded and maintained by anons - emerged as real threats to their clear-named counterpart: Uniswap.

Albeit its impact being controversially discussed, rumor had it that to counter Sushi, Uniswap, merely as a damage-controlling measure, launched its own governance token UNI. And today?

The space's state is that SushiSwap - a project without any traditional business foundation - generating weekly revenues of $1M through transaction fee collection; still consists of few with clear-named appearance while, in the meantime, its compliant older brother, Uniswap, found itself recently becoming under scrutiny by the world's most powerful financial regulator: The United States Security and Exchange Commission.

And that's the point where I believe we must backtrack and ask ourselves the delicate question posed at this article's beginning; bubbles and inflated expectations.

If tokenization and compliance is indeed a commercial detriment that leads to persecution and not tolerance, then won't we see the trend of crypto project anonymization accelerate? Or, instead, will we all - with the help of our lord and savior, the constitutional state - be guided towards the light and realize that the best bet to freedom and peace is detokenization?

Being a crypto company founder (rugpullindex.com) with an active clear-name avatar myself; my thoughts are this: Though I'm hugely in favor of secularizing the relationship of state and currency control, I concede to the idea that large parts of the world should remain under the authority of a state.

I don't think it has ever been crypto's aspiration to legislate atom space. Counter to that; it has actually continued to expand cyberspace into a now fully-functioning parallelized digital economy that was originally bootstrapped by Bitcoin and the likes. There's a reason that "you don't need a blockchain" in "real-life" applications. It's because blockchain wasn't and isn't built for "real"; It's cyber.

Then, thinking conceptually about this parallel economy, I think the state is right to have some entitlement about controlling the space's borders. And logically, it's why today we pay tax when selling crypto to fiat. However, I do feel that the state has started falsely taking responsibility when it started regulating what it cannot control.

On countless websites of countless states, the message is clear: Be prepared to lose it all when investing your money in crypto. Hence, how can then also exist a mandate to regulate the "illegal" issuance of "securities" when indeed the reality is that ERC20 tokens are being issued on Ethereum, a globally distributed ledger?

Couldn't we consider a nation-state "illegally leaving its sovereign territory" if it started policing a globally distributed project in cyberspace? Sure, the counterargument would be that the internet is a collection of routers, switches and cables controlled by yours truly; But to me, that's neither a technical requirement anymore nor is it informing the question of policing. Wouldn't e.g., the US literally overstep borders if it started policing a globally distributed crypto project?

As a founder in the space, these questions are indeed of existential matter. How must one behave in the face of these developments?

I, too, have had countless anonymous accounts and even launched minor projects with them. But have I been excited about them? Not that much. See, I didn't want and I still don't want to take the legal risk of anonymously contributing to DeFi. Neither do I want to physically move to a crypto-friendly jurisdiction either.

Ironically, on a technical level, I'd be capable of doing what the space's most successful are doing, but I'm hesitant about getting my hands dirty.

With my clear-named startup rugpullindex.com, I can't legally launch tokens in Germany; I mean, I could - but it'd be so capital and time-intensive that there wouldn't be a point. As an anon, I'd be capable - but could I make a living from crypto alone without becoming part of a parallel society? And don't I strive for recognition too?

So then, doesn't the original question framed at the beginning remain? Is the cryptocurrency market's evaluation subject to inflated expectations?

If crypto and DeFi are truly that great for innovation now, isn't it kind of ironic that after nine months of work, I'm starting to realize that my project's challenges don't lie within technology but are made of legal uncertainty?

Call me attached to my meaty identity, but I'd rather detokenize than anonymize.

published 2021-10-08 by timdaub